December 22, 2023

The Forest Preserve District of Cook County adopted its FY2024 budget on November 14 for the fiscal year beginning January 1. This is the second annual budget that is supported by a $40 million increase in property tax revenue approved by Cook County voters through a referendum question on the November 2022 ballot. As a result of the referendum, the Forest Preserve District’s annual adopted budget increased from $137 million in FY2022 to $182.2 million in FY2023, reflecting the first year of the additional property tax funding. The budget for the upcoming 2024 fiscal year increases slightly by an additional $6.5 million, reflecting growth in the cost of operations and personnel.

The Civic Federation supported the referendum question put forward to voters last year, which increased the Forest Preserve District’s property tax limiting rate by 0.025%, bringing the District’s total rate to 0.076% of the equalized assessed value of taxable property in tax year 2022. Even with the rate increase, the Forest Preserve District makes up less than 1% of the property tax bills paid by Cook County property owners. The increase in property tax revenue provides a recurring funding source that will enable the District to fulfill several long-term needs, including pension funding, land restoration and capital improvements.

Overview of the Forest Preserve District’s $188.8 million FY2024 Budget

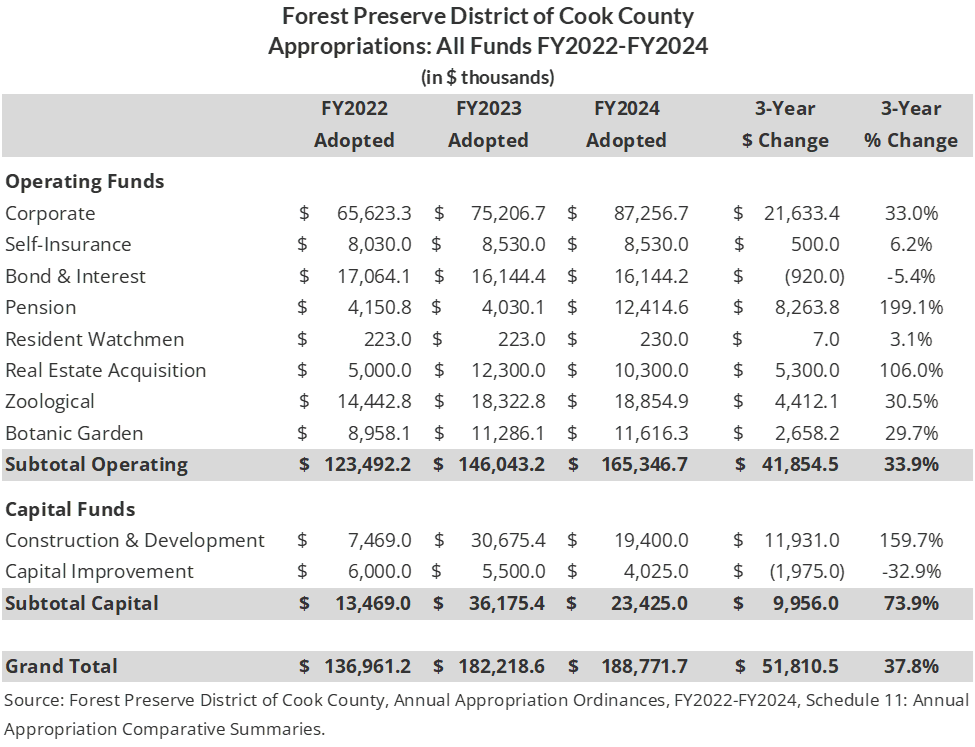

The Forest Preserve District’s FY2024 budget totaling $188.8 million represents a nearly 38% increase from FY2022. The adopted appropriations increased from $137 million in FY2022 to $182.2 million in FY2023, the first budget year incorporating the property tax increase. The FY2024 appropriations increase by another $6.5 million.

The largest increase is budgeted within the Corporate Fund, which is the District’s general operating fund and accounts for the District’s staff. Corporate Fund appropriations will increase by $21.6 million, or 33.0%, in the three-year period between FY2022 and FY2024. The FY2024 budget adds 41 full-time equivalent positions to support the District’s long-term strategic plans, bringing the number of total staff to 721 full-time equivalents. The Corporate Fund spending increase is also driven by 2% cost of living increases and renegotiated pay rates in collective bargaining agreements for Forest Preserve police officers, as well as inflationary pressures on non-personnel expenditures such as fuel, energy, technology and other operating costs. The FY2024 budget is part of a three-year ramp-up to set the district on a future growth trajectory. New full-time staff positions and other program expenditures will support the District’s long-term goal of implementing the Next Century Conservation Plan.

The Construction and Development Fund will increase substantially over the three year period, increasing from appropriations of $7.5 million in FY2022 to $30.7 million in FY2023, then dropping to $19.4 million in FY2024. The Pension Fund will also receive a significant increase in funding over this period, from $4.2 million in FY2022 to $12.4 million in FY2024. FY2023 was the first year that the District was able to make a full appropriation to the Pension Fund based on actuarial needs of the fund, which will help to reverse decades of underfunding of Forest Preserve employee pensions.

Appropriations to the Zoological Fund, which goes to Brookfield Zoo and the Botanic Garden Fund, directed to the Chicago Botanic Garden, will each increase over this period by about 30%. The $18.9 million directed to the Zoo and the $11.6 million directed to the Botanic Garden reflect only the tax subsidy provided by the District to the Brookfield Zoo and Chicago Botanic Garden, not the full operating budgets of each entity. Both the Zoo and Botanic Garden sit on Forest Preserve land and operate as cooperative functions of the Forest Preserves, but are operated and administered by the Chicago Zoological Society and the Chicago Horticultural Society respectively.

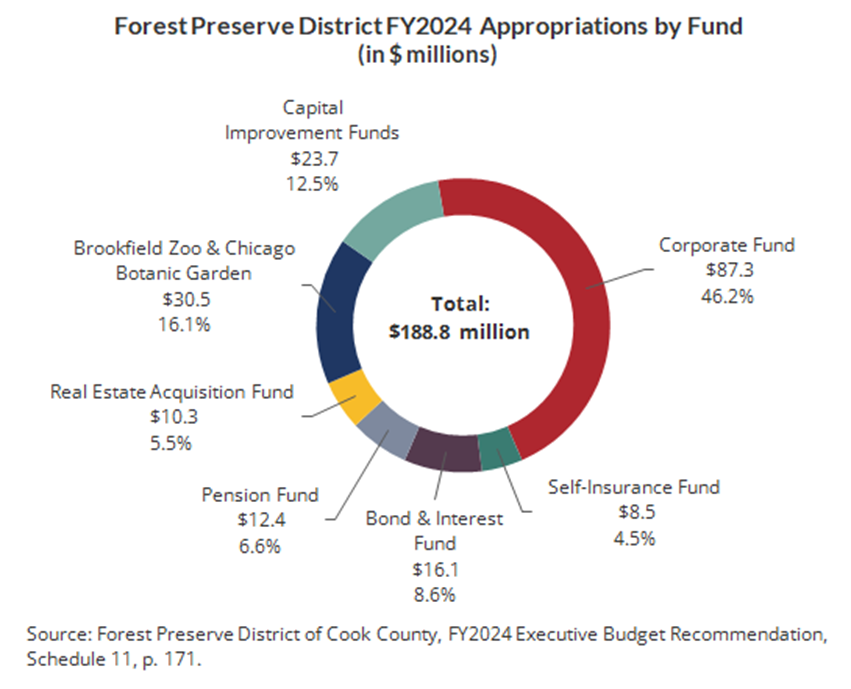

The influx of additional funds in FY2024 means that the District has been able to allocate more of total appropriations to capital improvements, real estate acquisition and pension funding. The chart below shows the distribution of appropriations by fund as a percentage of the total FY2024 budget. The Corporate Fund, or general operations, will account for 46.2% of total appropriations. Capital improvement funds, including both the Construction and Development Fund and Capital Improvement Fund, will receive 12.5% of the total budget. The Brookfield Zoo and Chicago Botanic Garden together will constitute 16.1% of total spending allocations. Real Estate Acquisition will constitute 5.5% of the total budget, compared to just 3.7% prior to the referendum. Likewise, the Pension Fund will represent 6.6% of the total budget, compared to 3.0% two years prior. The Bond and Interest Fund and Self-Insurance Fund have remained fairly steady in proportion to total appropriations.

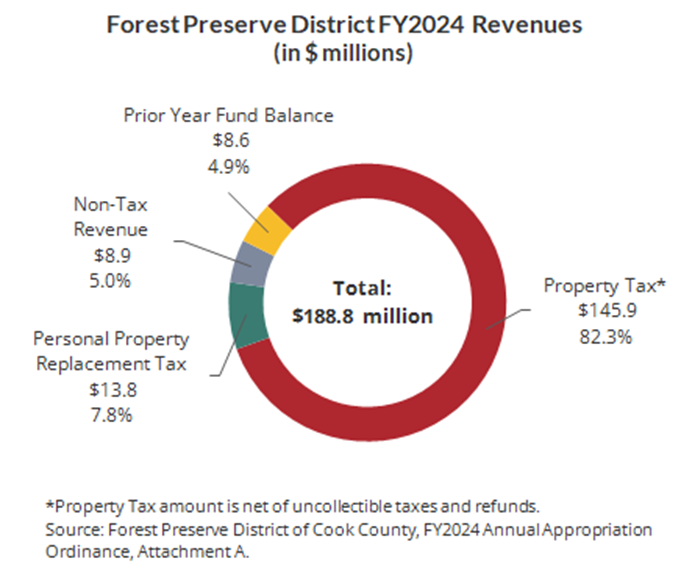

The Forest Preserve District’s budget is highly dependent on property tax revenue. Property taxes represent 82.3% of total revenue for the District in FY2024. The District’s only other tax source is personal property replacement tax, which is a corporate income tax collected and distributed to governments by the State of Illinois. Other sources of non-tax revenue for the district are generated from fees, fines, concessions, permits and charges from recreation such as camp sites, pools and golf courses. These non-tax revenues are expected to generate $8.9 million in FY2024. An additional $8.6 million in fund balance built up from prior years will round out the District’s total revenue anticipated in FY2024. This use of fund balance comes from a large reserve built up in the Corporate Fund available due to higher than expected revenues and lower expenditures in past years, and will be used primarily on one-time costs.

Distribution of Property Tax Revenue Since the 2022 Referendum

The approval of the 2022 ballot referendum question was estimated to generate approximately $40 million in additional property tax revenue for the District annually. Part of the reason the Civic Federation supported the property tax rate increase was the District’s publicly laid out plans for how the additional funds would be used. The District had planned to use the funds for a variety of needs including: funding the District’s pensions at an actuarially sound level in order to address a long-standing pension funding shortfall; deferred maintenance and capital improvements; supporting capital needs at the Brookfield Zoo and Chicago Botanic Garden; land restoration; and acquisition of more natural lands. A 2023 progress report of the Conservation and Policy Council of the Forest Preserves of Cook County submitted to Commissioners on October 17, 2023, confirms that the additional funds are being used in a manner consistent with priorities outlined to voters during the 2022 referendum.

The District’s FY2023 recommended budget was amended before being adopted last year to incorporate $41.4 million in new revenue across the priorities as presented in an overview of the referendum. The details of those amendments are described here. During 2023, the Forest Preserve District has begun to spend the funds, while acknowledging that it will take some time to fully realize the use of the funds. For example, funds reserved for the purpose of land acquisition will be held in a Real Estate Acquisition Fund to be built up over time.

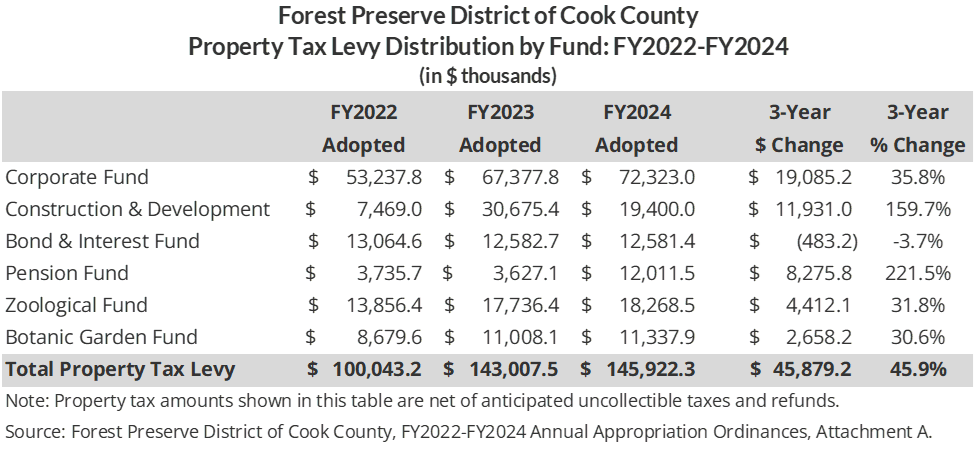

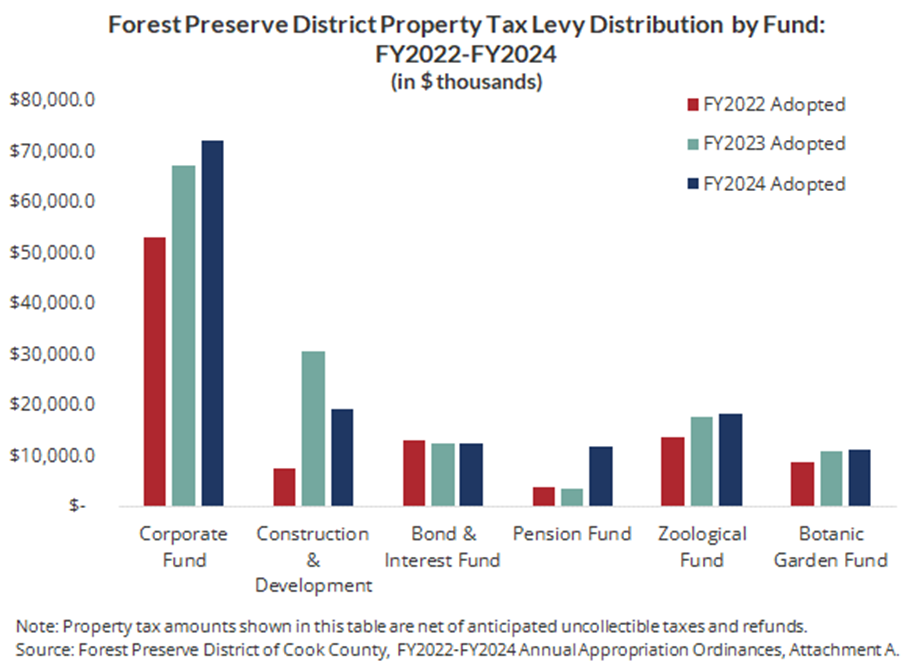

In terms of how the additional property tax allocations appear in the budget, the District’s property tax revenue distribution among six funds as shown in the table below. As shown, the Forest Preserves’ property tax levy increased from approximately $100 million in FY2022 to $143 million in FY2023, reflecting an increase of about $43 million. Property tax revenue will again increase slightly in FY2024 by $2.9 million, or 2%, from FY2023. This increase from FY2023 is due to the District’s levy capturing continued growth in property values.

It is important to note that the Forest Preserves’ property tax levy of just under $146 million is a very small percentage of the total property taxes billed in Cook County. Total taxes billed by all government districts across the entire County total $17.6 billion.

The largest increase in property tax revenue allocated between FY2022 and FY2024 will be within the Corporate Fund. The Construction and Development Fund, used for construction, restoration and improvement of facilities and District land, will receive an increase of nearly $12 million, or 160%, over the three-year period. Property tax allocated to the Bond and Interest Fund, which supports annual debt service payments, will remain fairly level. As planned, the Pension Fund, Brookfield Zoo and Chicago Botanic Garden each will receive increases in their property tax allocations as well.

The chart below further illustrates these property tax revenue increases distributed to the six funds identified in the table above during the three-year period between FY2022 and FY2024.

The property tax rate increase for the Forest Preserve District puts this government agency on much more stable footing. Just a few years ago, the Forest Preserve District had limited revenue options and no easy solutions to resolve how the District would address its pension funding crisis, pay for a $130 million capital projects backlog and pay for the ambitious Next Century Conservation Plan. Now that a stable and recurring revenue source has materialized, this will help the District accomplish its goals. As the Civic Federation has praised the Forest Preserve District administration before, we continue to commend the District for its strong financial management practices and fulfilling its mission of making the Forest Preserves a welcoming environment for all County residents. We hope to see a continuation of the improvements made by this fiscal administration over the past decade, as well continued levels of transparency around use of the new property tax funds going forward.